Africa - large, unused investment potential [Guide]

Interest in investing in Africa is growing, but it is happening very slowly. Only a few decided to permanently associate with this region. Why is it like that? What can this continent offer investors? What are its development prospects? And what are the stock exchanges on the Black Continent like? We will seek answers to these and many more questions in this article. First things first.

Forgotten continent?

Africa is the cradle of humanity. The fascinating history of this continent is often unknown. However, during the Middle Ages there were countries on this continent. An example is the Mali Empire, the most famous ruler of which was Mansa Musa, who became famous for his pilgrimage to Mecca (1324 - 1325). Musa's retinue caused considerable generosity through its generosity inflation (decline in gold value) on the pilgrimage route. Another example of a country with a developed culture and craftsmanship was Songhaj. However, empires did not arise just north of the equator. One of the most famous empires in the southern part of Africa was the Monomotapa. In today's Zimbabwe, there is a "medieval" complex "Great Zimbabwe", which has been included in the UNESCO World Heritage List. The Caliphate of Sokoto also went down in history. When mentioning Africa, it is impossible to ignore countries such as Egypt or Ethiopia, whose history is fascinating. Due to various cultural, historical and religious conditions, it cannot be said about "one Africa" and "Africa's problems". Of course, in some countries of the region there are similar "problems", but certainly the "nuances" should be noticed. Egypt has different challenges, Botswana and Chad.

The ignorance of Africa also applies to economic matters. For this reason, there is an opinion that African countries have similar problems and economic structure. However, this is not true. The same applies to the advancement of economies. Of course, it's hard to find an African country that tops the list Global Competitiveness Index. The highest position, apart from Mauritius, is taken by South Africa (60th place), followed by Turkey (61), Croatia (63) and Brazil (71). However, it should be noted that African countries dominate below 110 places. The lowest place in 2019 was recorded by Chad (141).

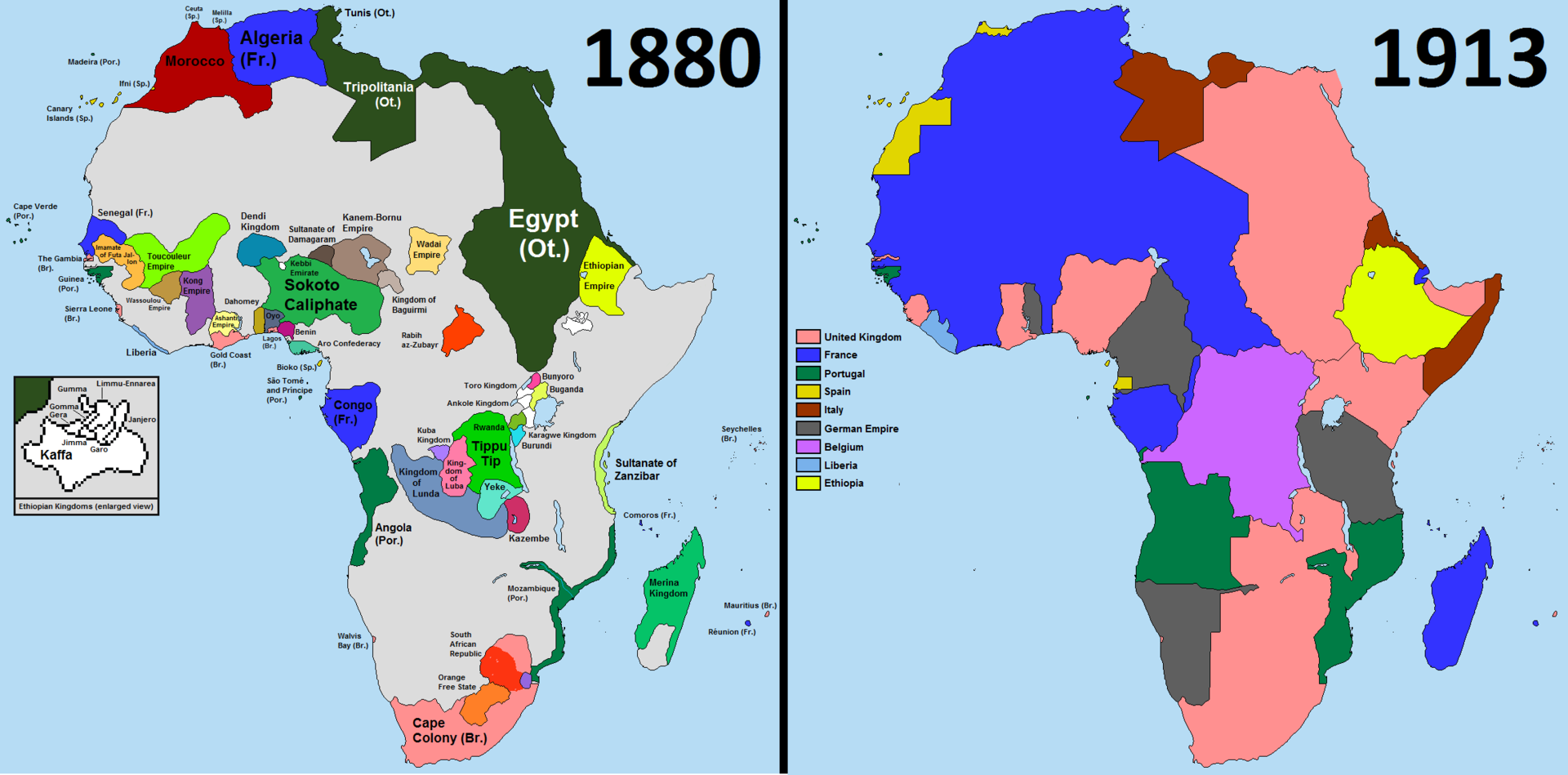

Race for Africa

He had a great influence on the current development of African countries "Race for Africa"which lasted from 1881 to 1914 (some say 1885). As a result, the race of European powers led to quickly colonize 90% of Africa (Liberia and Ethiopia maintained their independence). The countries responsible for colonialism in Africa were Great Britain, France, Belgium, Germany, Italy, Portugal and Spain. Arbitrary decisions regarding territorial division, modernization in a European fashion and the often destructive economy have had an impact on the development of Africa for many years. Let the case testify to the brutality of colonization Congo Free Statewhen Leopold II was brought to death under the "rule" of the king of the Belgians at least several million inhabitants these sites. The case was widely echoed in European journalism at the turn of the XNUMXth and XNUMXth centuries. An example would be a book Heart of Darkness, written by Joseph Conrad. European states competed for influence in the colonies, which often placed them on the verge of war. An example is the two Moroccan crises that took place just before the First World War.

Decolonization

After the Second World War, Africa was decolonized. It was not always peaceful. An example is the war in Algeria, which lasted between 1954 and 1962. The war cost many lives and a large emigration of the French and the harki community from Algeria.

However, very often countries' independence was achieved peacefully. 1960 is often called "The Year of Africa". It was then that 17 countries declared independence. These include: Cameroon, Senegal, Togo, Upper Volta (Burkina Faso) and Nigeria.

Unfortunately, the borders of the newly formed states coincided with the "colonial" lines that were not adapted to the "cultural mosaic" found inside African states. For this reason, many countries have witnessed enormous destabilization. In the case of Nigeria, between 1967 and 1970, Biafra broke off the country. The conflict and the economic blockade led to famine in Biafra. As a result, about 1 million people died.

Another example is the 12-year civil war in Burundi, the Tutsi massacre in Rwanda and the civil wars in the Congo. In particular, the Second Congo Civil War involved 8 African countries and resulted in the death of over 5 million people (mainly due to disease and starvation).

Many countries have problems with internal stabilization. There are coups in some African countries that cause even greater political and international instability. An example is the Central African Republic, which was plagued by numerous coups during 60 years of independence. The years 1976-2003 were particularly turbulent in this country.

International cooperation in Africa

From 1963, integration trends appeared in Africa. The first such organization is Organization of the Nations of Africawhich in 2002 became The African Union, uniting the countries of this continent. The African Union unites countries with an area of 29 million square kilometers, where 1,3 billion people live. The working languages of this organization include Arabic, English, French, Swahili and Spanish. The seat of the organization is in Addis Ababa (the capital of Ethiopia).

Of course, there are also "regional" organizations in Africa. An example would be Arab Maghreb Unionwhich was created in 1989. The capital of the association is the Moroccan Rabat. The members of the organization are Algeria, Libya, Morocco, Mauritania and Tunisia. However, due to conflicts within the organization, it is difficult for the Arab Maghreb Union to make binding decisions.

Among other organizations can be mentioned East African Community (ECA), which groups 6 countries: Burundi, Kenya, Rwanda, Tanzania, Uganda and South Sudan. It groups countries with a population of more than 174 million and a GDP of more than $ 163 billion.

Another example is CEN-SAD (Community of the Sahel and Sahara States), which is one of the largest regional African organizations. It was established in 1998 and currently associates 29 countries. These are mainly countries from the North of Africa.

Of course, the integration of African countries is not only political, but also economic. An example is the uprising AfCFTA (African Continental Free Trade Area). The agreement concerns the creation of the African free trade area, which will bring together around 1,3 billion people. The agreement was signed by 54 African countries. Less than 40 countries have ratified the agreement. The organization's task is to increase trade between the members of the organization, which is to accelerate the economic growth of the countries of the region.

China Investments

At the beginning of the existence of independent African states the main investors were the countries of the "West" and the USSR. After the collapse of the Union of Soviet Socialist Republics, the "Western countries" were the undisputed leader. Very often, foreign investors came from former metropolises. For example, in the former French colonies, French companies were very active in economic activity, and many former colonies accepted Frank CAF for settlement, who was pegged to the French franc before the euro. There have been accusations of "neocolonialism" very often. Very often, African countries fell into debt traps, and debt cancellation became almost routine.

Currently in Africa invests a lot "Middle Kingdom". China is focused on securing financing for infrastructure spending. In 2005-2019, they financed around $ 340 billion in infrastructure construction in sub-Saharan African countries. It is also worth mentioning the financing of the railway linking Ethiopia with the port of Jubiti. Another investment in Ethiopia was the construction of a hydroelectric plant, which cost $ 2,7 billion. 85% of the expenditure was financed by the Chinese side. China also helped develop Algeria's expressway network. It is worth mentioning that Chinese companies win a large number of government contracts on the African continent and receive lucrative permits to extract raw materials. At the end of 2019, there were 10 companies operating in China, most of them private.

At the same time, trade is developing dynamically, which in 2019 exceeded $ 200 billion. For most African countries, China is the largest trading partner. Chinese investments in Africa are expected to continue in the coming years. This will not only apply to "concrete infrastructure", but also to the development of 5G technology in the most promising countries in Africa. In the last year, China also conducts "vaccine diplomacy", offering COVID-19 vaccines to African countries. The offer was used by, among others Zimbabwe.

The most populous countries of Africa

Unlike Europe and China, African countries are steadily increasing their populations. In most countries, the population is very young. In Africa, about 60% of the population is under the age of 24.

As many as 10 African countries have a population larger than Poland. Nigeria has the largest population, exceeding 195 million. The next country in terms of population is Ethiopia, with a population of over 110 million. Egypt closes the podium with the result of 98 million.

According to the United Nations projections, in the years 2020-2050 the average annual population growth rate exceeds 2%. It is the greatest increase of any continent. In the neutral variant, in Africa, by the end of 2050, the population is expected to be around 2,5 billion. The largest population growth will apply to the countries of Central Africa (average population growth 2,55%), which include, among others, Angola and the Democratic Republic of the Congo. The slowest growth rate will be among the countries of South Africa (including South Africa, Botswana, Lesotho, Namibia).

The largest economies of Africa

In 2020, the Gross Domestic Product of African countries exceeded $ 2 billion. However, the top 333 economies produce more than half of the continent's GDP. Africa's largest economies are:

- Nigeria,

- Egypt,

- South Africa,

Nigeria

It is the most populous country with the largest economy on the continent ($ 467 billion). It is a successive economy. The main export product is crude oil. High crude oil prices allowed the country to pay off old loans (including to the Paris Club). As a result, at the end of 2019, the debt to GDP ratio was below 20%. However, it should be mentioned that the country has not been able to use the potential offered by the huge deposits oil. A large percentage of the population still lives in poverty and agriculture generated 2019% of GDP in 21,9. One of the main products is Kakao, Palm oil or peanuts. It is also the largest producer Cassava and yam in the world. The sale of oil was not used to modernize the economy. The country still has problems with corruption (low rank in Corruption Perceptions Index). Please note that Sharia law applies in the northern states of Nigeria. At the same time, the Boko Haram organization operates in Nigeria, which is trying to introduce sharia also in the southern (Christian) part of Nigeria through terrorist attacks.

Check it out: How to invest in COCOA? [Guide]

Egypt

It is one of the most famous African countries. It is also the third most populous country in the continent. Egypt is mainly associated with the pyramids, sphinx and desert sands. However, it is also the second largest economy in Africa ($ 375 billion). This makes Egypt the economy of the "fourth ten" in the world. At the same time, it is not a very developed country, as GDP per capita is slightly above $ 3000 (132nd place in the world). Adjusted for purchasing power parity, GDP per capita exceeds $ 12 (000th place). The main export product is clothing and its derivativeswhich in 2019 accounted for over 25% of exports. Egypt also has developed agriculture which accounts for around 11% of the Gross Domestic Product. Egypt is the world's largest producer dates and fig. It is also one of the largest tomato producers in the world.

South Africa (South Africa)

It is one of the most developed countries in Africa. It has a very diversified and technologically advanced economy. It also has the most developed capital market among African countries. Even so, the country is currently struggling with low pace of economic growth and high unemployment (27,5%). The main export products are raw Materials (including precious metals) and cars. The largest trading partner is China, which is both the largest importer and exporter. South Africa is also a cultural and linguistic mix. 11 languages are spoken in South Africa. The following societies dominate: zulu (22,7%), xhosa (16,3%), Afrikaas (13,5%), English (9,6%) and pedi (9,1%).

African countries are not currently among the world's largest economies. It is worth mentioning that Poland has a larger economy than Nigeria, which is the leader in Africa. According to the estimates of the International Monetary Fund, in 2021 Nigeria will be the 26th economy in the world.

It is also no surprise that African countries do not have the most developed economies in the world. In terms of GDP per capita, the Seychelles are the leader with the result of $ 12,3 thousand (not taking into account the purchasing parity). However, it should be mentioned that the GDP of this island country does not exceed $ 1,3 billion. Among the economies with a Gross Domestic Product in excess of $ 15 billion, the "richest" are Gabon (7,185 thousand GDP per capita), Botswana ($ 6,55 thousand) and South Africa ($ 5,24 thousand). For comparison, Polish GDP per person (nominal) amounts to 16,7 thousand. $.

Development of African countries

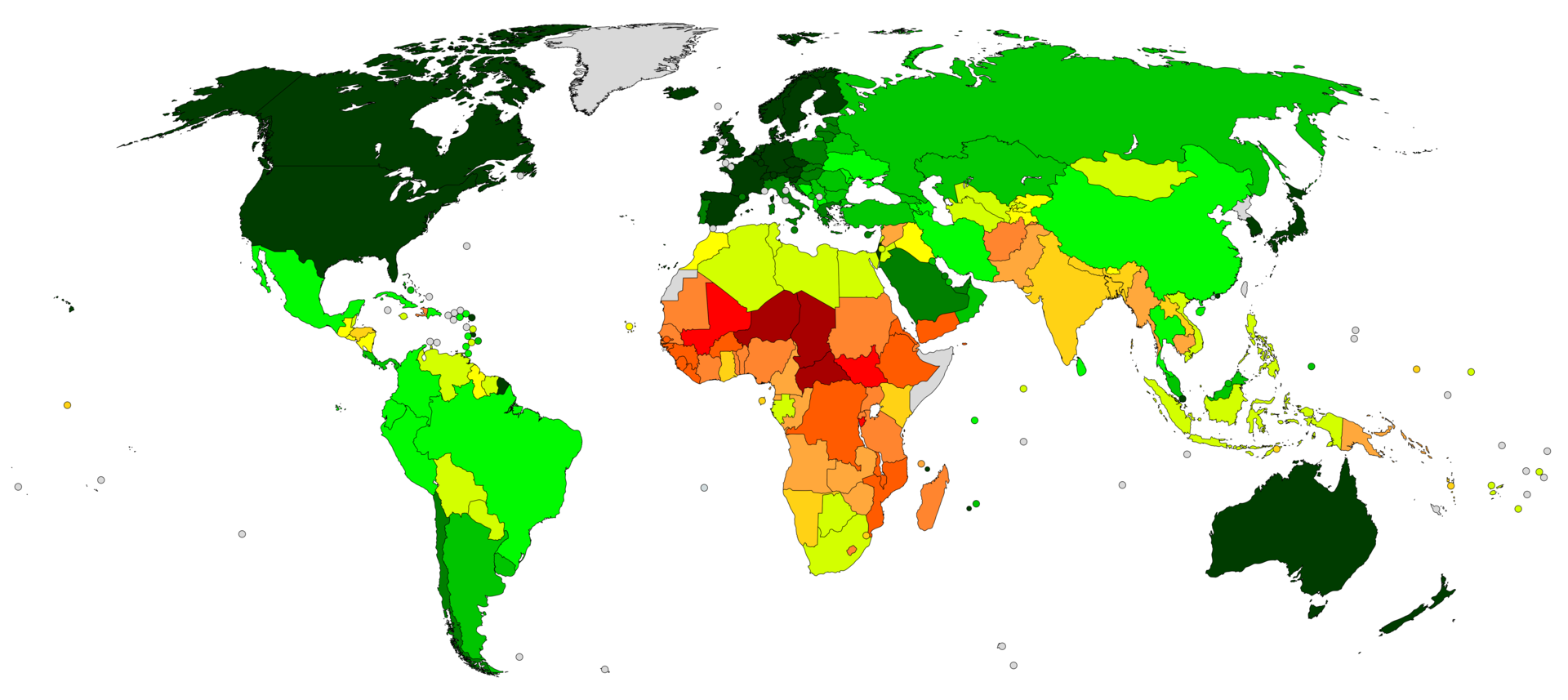

The African continent is considered underdeveloped. It confirms it HDI index (Human Development Index). The indicator assesses countries in terms of variables such as: expected quality of life, quality of education or national income per person. It is worth noting that individual countries have different development indicators. In the chart below, the browner the indicator, the worse the HDI result. Countries such as Chad, Niger and the Central African Republic fared very poorly. South Africa, Botswana, Algeria, Egypt, Tunisia and Libya stand out positively.

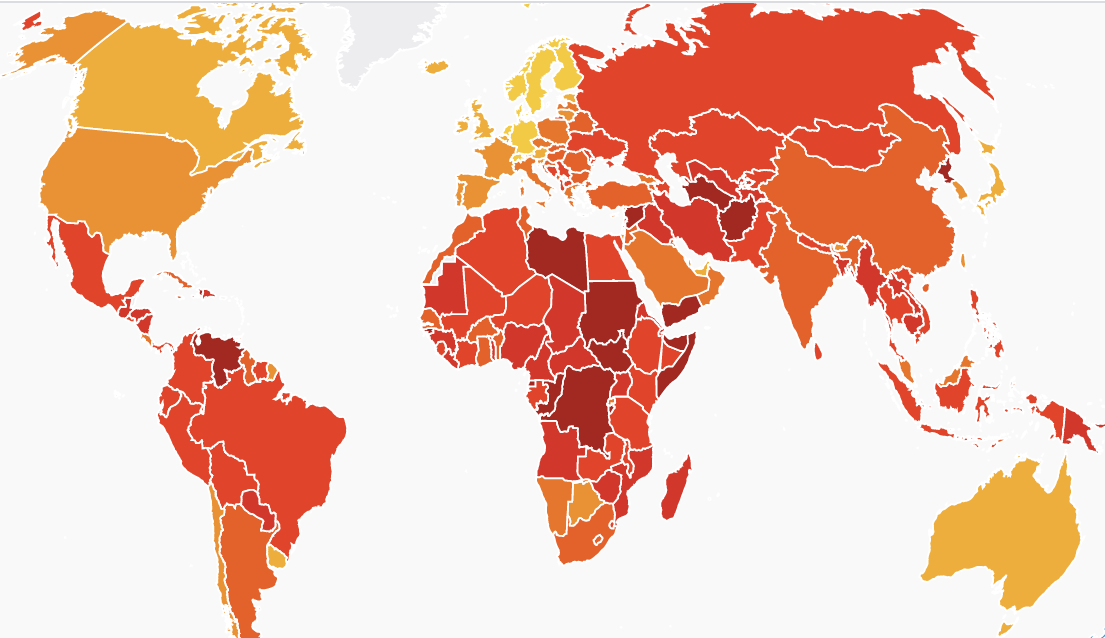

Many African countries have a problem with corruption as shown in the Corruption Perceptions Index by Transparency International. An example is the Democratic Republic of Congo (170th place), Sudan (174th). One of the African leaders is Botswana, which ranks 35th (on a par with Israel).

Major stock exchanges in Africa

The capital market in most African countries is not very well developed. The largest African stock exchange is JSE (Johannesburg Stock Exchange).

JSE is the South African stock exchange, on which over 400 joint-stock companies are listed. Stock market capitalization exceeds $ 1 billion. It is one of the oldest exchanges in Africa. It was founded in 000, four years after the founding of the Egyptian Alexander Stock Exchange. The Johannesburg Stock Exchange is among the top 1887 largest stock exchanges in the world. The most important indices of this exchange are the FTSE / JSE Top 40 Index and the FTSE / JSE All Share Index. The companies listed on the stock exchange include Naspers, Prosus, Spar and Vodacom.

The oldest stock exchange established in Africa was the Alexandrian Stock Exchange (1883). It is currently part of the EGX (Egyptian Stock Exchange). There are 181 listed on the Egyptian stock exchange. The most important index of the Egyptian stock exchange is the EGX 30. Commercial International Bank (Egypt) and Egypt Kuwait Holding can be mentioned among the essential components of this index.

An important point on the stock market map of Africa is Nigerian Stock Exchange (NSE - Nigerian Stock Exchange). It is one of the five largest stock exchanges in Africa. The history of NSE goes back to 1960 when the Lagos Stock Exchange was established. The Nigerian Exchange Group is listed on the US Over-Regulated Market (OTC). Its capitalization in April 2020 exceeded $ 125 million. At the end of April 2021, 376 companies were listed on the market. The capitalization of all listed companies exceeds 39 billion nair (approximately $ 000 billion). The most important indices of the Nigerian stock exchange are the All-Share Index (established in 94) and the NSE - 1984. The components of the NSE 30 index include Nestle Nigeria, Nigerian Breweries and Unilever Nigeria.

One of the largest exchanges is also Moroccan Casablanca Stock Exchange. It was founded in 1929. The capitalization of all companies is $ 68 billion (over 611 billion Moroccan Dirhams). The MSI 20 (Marocco Stock Index) is worth mentioning among the main indices of the Moroccan stock exchange. Examples of the index components are: Maroc Telecom or Attijariwafa bank.

Despite the underdeveloped capital markets, many African countries are slowly improving. More and more companies are appearing, the least developed markets are introducing their stock exchanges (including Angola, Rwanda, Somalia). In 2021, a stock exchange will be launched in one of the most populous country in Africa - Ethiopia (Ethiopian Stock Exchange).

How to invest in African companies?

An individual investor has limited investment space in the African market. As a rule, investors have access to the continent's largest stock exchange - the South African JSE. Another option is to buy stocks of companies that are listed on major stock exchanges. However, the disadvantage of such a solution is a small selection of companies.

As a result, one of the more effective options for investing in shares of African companies is the use of ETF offers listed on major stock exchanges in the world. Below is a list of ETFs providing exposure to the African market.

VanEck Vectors Africa Index ETF (AFK)

One of the ETFs giving exposure to the African market is VanEck Vectors Africa Index ETF (AFK). Assets under management (AUM) at the end of March 2021 totaled $ 54 million. The index comprises 73 companies. South African companies dominate with 33,5% share in assets. It is followed by Moroccan (18,2%) and Nigerian (14,5%) companies. They prevail in the ETF financial companies (32,9%) and z material industry (25,9%). They have the largest share in AFK Naspers shareswhich have an 8,4% share of the ETF. They are in the next place Safaricom (6,4%) and ATTIJARIWAFA Bank (5,6%). Net Expension Rate is 0,79%. So it is not a very cheap ETF.

Global X Nigeria Index ETF

ETFs with country exposure can also be purchased. Examples include ETFs for the Egyptian, South African and Nigerian markets.

For investors looking to invest in companies from the largest African economy, one of the options is Global X Nigeria Index ETF. It groups 20 Nigerian companies. The benchmark for the ETF is the MSCI All Nigeria Select 25/50 index. At the end of March 2021, there were $ 40,4 million in assets under management. The largest component of the ETF is Dangote Cement PLC (13,9%). The ETF is dominated by companies from the financial sector (48,2%) and consumer goods (25,6%). ETF costs calculated as TER (Total Expense Ratio) amount to 0,89%.

VanEck Vectors Egypt Index ETF (EGPT)

One of the ETFs giving exposure to the Egyptian market is VanEck Vectors Egypt Index ETF (EGPT). Assets under management (AUM) at the end of March 2021 amounted to $ 18,5 million. The index comprises 26 companies. The ETF is dominated by companies from the real estate (23,3%) and financial (21,7%) sectors. The largest share in EGPT is held by Egypt Kuwait Holding shares, which have 8,7% share in ETF. Commercial International Bank Egypt (7,7%) and Talaat Moustafa Group (6,2%) are next. Net Expension Rate is 0,98%.

iShares MSCI South Africa

ETF with exposure to the South African companies market this iShares MSCI South Africa. The ETF mimics the performance of the MSCI South Africa 25/50 index. At the end of April 2021, the assets under management were approximately $ 336 million. The ETF consists of 37 companies. Enterprises from the materials (28,2%) and financial (25,6%) industries dominate. Naspers has the largest share in ETF (20,4%), followed by Firstrand (5,75%) in terms of size. The ETF management cost is 0,59%.

Forex brokers offering ETFs

Forex brokers have a wide range of shares, CFDs on shares and ETFs in their offer.

For example on XTB Today, we can find over 3500 equity instruments and 400 ETFs, a Saxo Bank over 19 companies and 000 ETF funds.

| Broker |  |

|

| End | Poland | Denmark |

| Number of exchanges on offer | 16 exchanges | 37 exchanges |

| Number of shares in the offer | approx. 3500 - shares circa 2000 - CFDs on shares |

19 - shares 8 - CFDs on shares |

| The amount of ETF on offer | approx. 400 - ETF approx. 170 - CFD on ETF |

3000 - ETF 675 - CFD on ETF |

| Commission |

0% commission up to EUR 100 turnover / month | according to the price list |

| Min. Deposit | PLN 0 (recommended min. PLN 2000 or USD 500, EUR) |

PLN 0 / EUR 0 / USD 0 |

| Platform | xStation | SaxoTrader Pro Saxo Trader Go |

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. From 72% to 89% of retail investor accounts record monetary losses as a result of trading CFDs. Think about whether you understand how CFDs work and whether you can afford the high risk of losing your money.

Summation

Africa will be there in the coming decades the fastest-populated continent in the world. The continent will also have the youngest population in the world. As a result, these countries can fully benefit from the demographic rent.

Of course, population growth alone can do more harm than good if countries are unable to provide a stable legal environment. If stable and efficient government institutions are created, which will allow to release the innovativeness of society, it will be possible to create jobs that will "absorb" next generations of workers. Otherwise, there may still be a vicious cycle with population growth generating internal tensions and famines. This in turn will "revive" ethnic conflicts, which will also reduce the internal stability of states.

Due to the fact that most countries are LDCs, there is a chance for rapid development in the years to come. "Hunger for infrastructure" are trying to fill, among others Chinese companies. This can help develop African companies related to the construction and telecommunications sectors.

However, be aware that many of the African countries struggle with corruption problems and low internal stability. Of course, not all countries can be put in one basket. An interesting example is Botswana, which was able to use the rich deposits of diamonds to raise the level of development in this country. As a result, the country has one of the continent's highest per capita GDP ratios. Raising the standard of living in Africa will also translate into greater consumption of higher-order goods.

The investor should also be aware of the currency risk. A weakening of the local currency may cause the return on investment (in the investor's currency) to be much weaker than the rise in the share price (in national currency).

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Africa - large, unused investment potential [Guide] africa investing etf](https://forexclub.pl/wp-content/uploads/2021/05/afryka-etf-inwestowanie.jpg?v=1620294652)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-300x200.jpg?v=1676364263)

![Africa - large, unused investment potential [Guide] Petroleum](https://forexclub.pl/wp-content/uploads/2021/05/ropa-naftowa-saxo-bank-maj-102x65.jpg?v=1620296230)

![Africa - large, unused investment potential [Guide] Short Squeeze - how it works](https://forexclub.pl/wp-content/uploads/2021/05/Short-Squeeze-jak-to-dziala-102x65.jpg?v=1620224657)