Average daily price range (ADR) - use the advantage in everyday trading

The average daily price range, which is popular ADR (from the Average Daily Range) is very often completely overlooked by investors on the forex market. It's worth taking a closer look at the use of this variable because using it in everyday trading can significantly improve our trading.

What is ADR

Very often, when analyzing a particular value on We do not wonder why the next candles look just like that and not otherwise. The forex market is attractive to investors mainly due to its volatility combined with leverage. However, a significant part of traders do not wonder where this variability comes from and why it is shaped at a given level. Of course, there are anomalies on all instruments that are difficult to predict, but markets are assumed to be cyclical and have certain specific parameters.

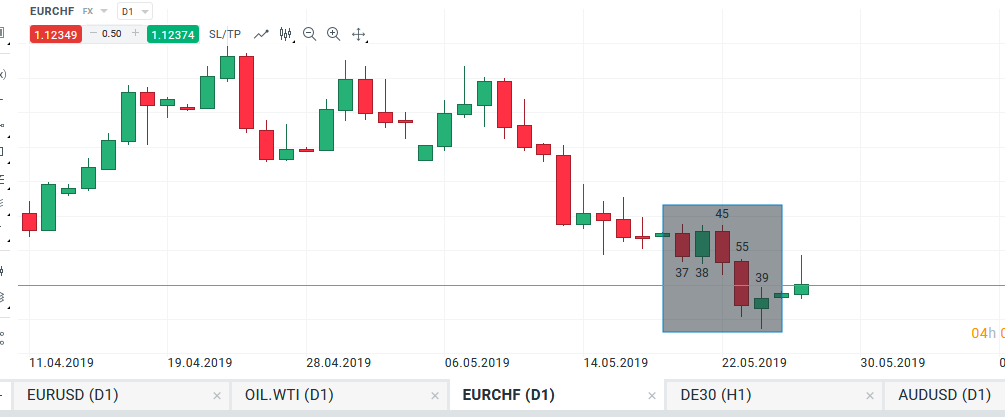

ADR is nothing else average daily price range on a given market. In the case of currencies, individual movements are expressed in pips. Therefore, ADR is nothing more than the price of a given day expressed in pips. It is also worth noting that the whole ADR concept does not necessarily have to be linked to other indicators available on trading platforms. If we do not want to use the indicators and adhere to the principle that they distort our view of the market, the average range in which the price moves, we are able to determine ourselves. Based on the daily ADR, we can determine the average range for each of our interesting time interval. For example, we choose the market that interests us, measure the range of individual candles and determine the average price range, for example for a given week.

Example of ADR determination, currency pair EURCHF D1. Source: xNUMX XTB xStation

Use of the average price range in practice

The ADR concept is based on a simple assumption. Every market, no matter whether it is a stock market, currency market or futures market, has its average distance that it overcomes every day. Information about this how far / to what extent the price moves every day, it can be extremely helpful when planning and determining entry into the position. Why can such information be so useful? Because knowing the ADR for a particular currency pair, of course excluding the anomalies that occur in every market, we are able to predict with certainty, e.g. where approximately the top or bottom for the session will be found.

Be sure to read: What time is it best to trade?

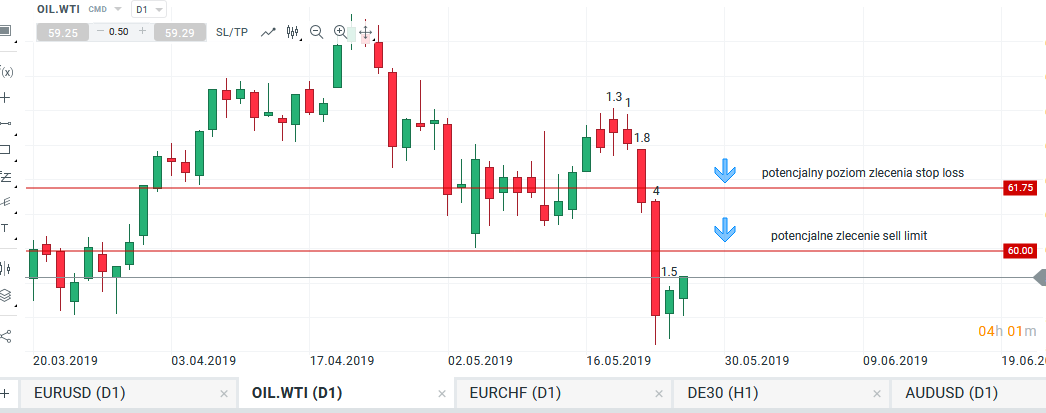

Another case where it is useful to use medium range are blind entries, i.e. without additional confirmation. Not all traders prefer to wait for an additional confirmation in the form of a suitable candlestick after breaking a key level. The question is also very often raised, how much should our SL order count for this type of play. To increase your chances, you can successfully apply the average price range (there are even special indicators and automatic SL setting based on ADR and ATR). An example would be WTI crude oil market. There was a break in the strong support around 60 points. For traders who want to go short in this market, there has been no retest of the broken level so far. Using the average daily range from the past week, we know that it fluctuates around 1.8 pips / point. By placing a pending order near the broken level, measuring a given range, we get a level where more or less our stop lossin order not to accidentally break it. Of course, if the market permanently returns above the level of 60 points, it will negate the signal.

The use of a medium price range when setting a stop loss order, crude oil WTI D1. Source: xNUMX XTB xStation

Summation

Using ADR, remember that:

- Keep it simple - you do not necessarily need to use the indicators built into the platform, the range you are interested in, you are able to calculate yourself,

- ADR is always better at combining with key support and resistance levels,

- Using the medium price range yields the best results at higher time intervals.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![No-name trading strategy that (positively) surprises [Video] no-name strategy](https://forexclub.pl/wp-content/uploads/2022/02/strategia-bez-nazwy-300x200.jpg?v=1645099039)

Leave a Response